As we enter the second quarter of 2025 there is uncertainty in the greater economy. It is hard to keep up with the day-to-day news regarding tariffs, DOGE cuts, immigration, and how they influence the financial markets. Financial markets have experienced turmoil in recent weeks and cast uncertainty across world markets. These developments are concerning, but not in our area of expertise. Our focus is on the local Twin Cities residential real estate market, and we are happy to report that our market is active and strong.

Recessions & Real Estate

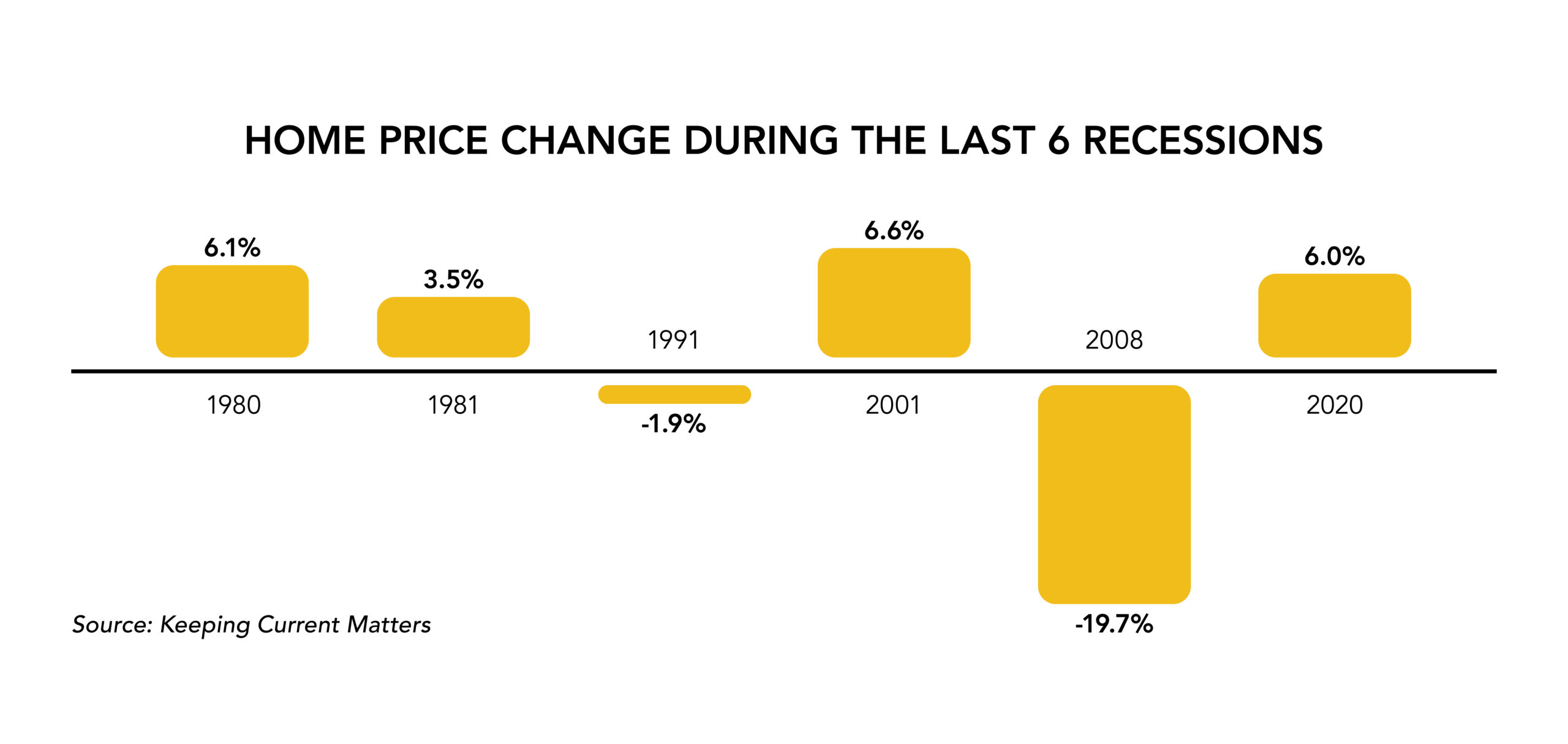

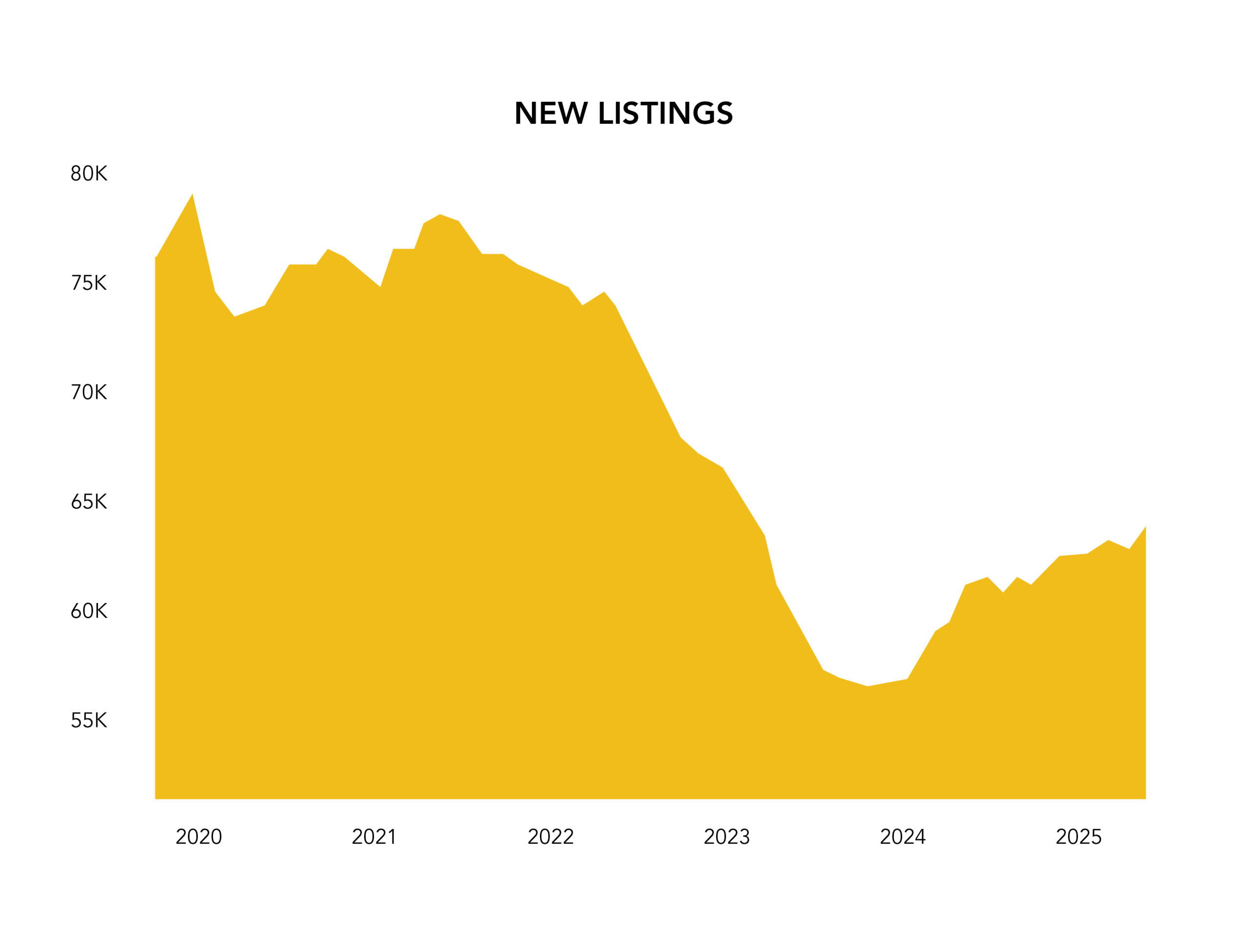

There has been talk of a recession recently, which is concerning for the broader economy. However, in 4 of the last 6 recessions, home prices actually went up. That’s because even when the economy is down, home prices tend to stay on the same trajectory they’re on, and right now, they’re rising in the Twin Cities. So far, the residential real estate statistics in the Twin Cities have improved over last year’s. New listings have increased 12%, accepted purchase agreements are up 5.5%, and home prices rose 3.5% to $380,000, over last year. Keep in mind that these stats are a snapshot in time, but they allude to a healthy market. Buoyed by slightly lower interest rates and an increase in listings, buyers and sellers are seeing opportunities in these uncertain times.

Find out instantly what your home may be worth here!

Interest Rates

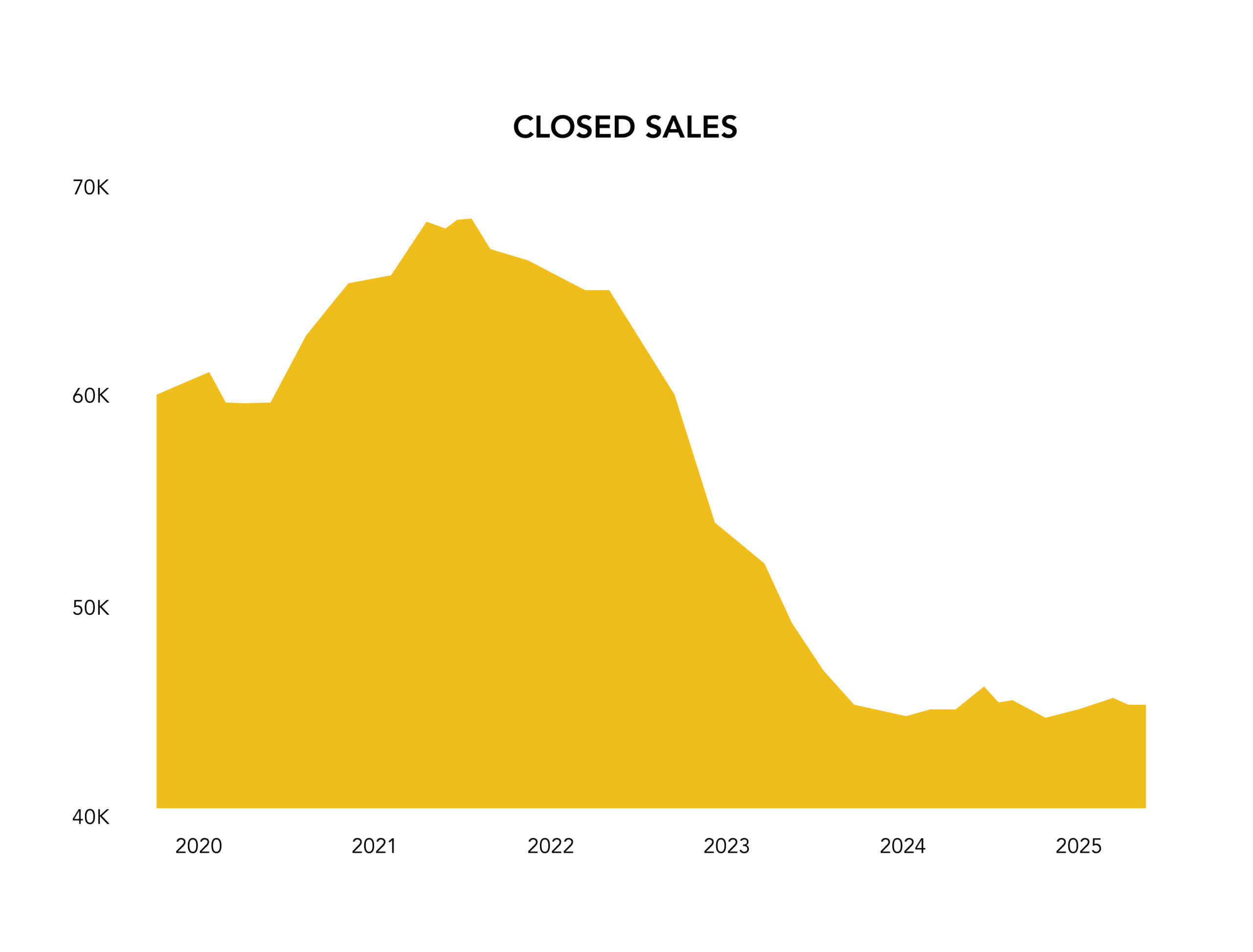

The local residential market experienced a post-covid slump in sales in 2023 & 2024. The primary reasons for this were increasing interest rates and lack of listing supply. We will add a third aspect that will have an increased influence on the real estate market: consumer confidence. Fortunately, we seemed to have turned the corner with interest rates and listing supply showing slight improvements. The spring real estate market has been active and competitive. Many new listings, which are priced and marketed correctly, are selling quickly at or above their listing price. Multiple offers are common. Consumer confidence is hard to quantify, but we will be keeping a close watch on what the sentiment is for buyers and sellers this year.

(Helpful tool: Mortgage Calculator)

Property Type Matters

Sales are not equal across the board when we take a closer look at property types. Single family homes and town homes sold at a higher rate and 50% faster than condos. Previously owned home sales rose while new construction sales declined. Sales of homes priced under $1 million declined slightly while home priced above $1 million rose nearly 20%. As you can see, to tru

ly understand the market, one needs to look deeper than the general statistics.

Here for You for 60 Years and Counting

In these uncertain times, it is important to pay attention and gather factual information. At Fazendin, we take pride in keeping current on all aspects of our specific markets. Every home is unique, and it is important to take that into consideration when providing information about a

particular area, property type, and price range. Whether you are considering a sale or purchase or just curious about the Twin Cities residential real estate market, at Fazendin, we have the knowledge and tools to provide you with customized, up-to-date information that is of interest to you. Do not hesitate to reach out to us.

Fazendin has been in the residential real estate space for 60 years and has experienced good markets, challenging markets, and everything in between. Whatever happens in the coming months, rest assured we will keep you informed. •