Curious about the current state of real estate markets across the United States? Look no further. In this insightful blog post, our generous LeadingRE affiliated brokerages have provided us a high level overview of their diverse market. Each has its own unique dynamics and stories to tell. From the bustling streets of Denver, Colorado, to the sunny shores of Jacksonville, Florida, and the historical neighborhoods of Newark, New Jersey, to the vibrant atmosphere of Oakland, California, you’ll get an idea as to what’s heating up or cooling down in these real estate landscapes.

Whether you’re a prospective buyer, seller, or simply a real estate enthusiast, we’re here to provide you the knowledge you want and need about today’s real estate market.

Denver, CO – WK Real Estate

What’s the temperature of Colorado’s real estate market? The Realtor.com Market Hotness Index indicates the degree to which a given area experiences fast-moving supply and high demand. Here is how Colorado’s major cities land on the hotness gauge this month:

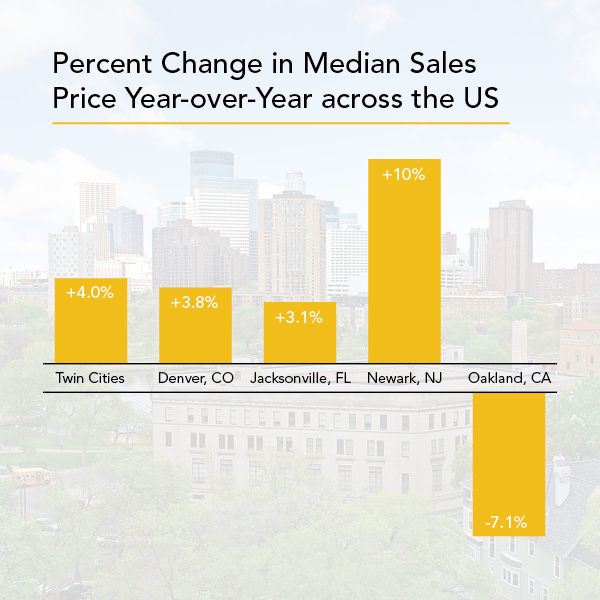

While the nation’s median list price declined compared to the same time last year for the second month in a row, things looked slightly better in the greater Denver metro area. The median sale price in July 2023 was $675,000, a respectable 3.8% increase year over year, thanks in part to the classic effects of supply and demand. Active listing inventory was down almost 11% compared to the same period last year, and new listings were down just under 25%. The West as a region saw declines of over 33%.

The typical home spent 31 days on the market this July, which is 8 days longer than the same period last year. This is still less time on market than we experienced pre-pandemic, which indicates the housing market in the greater Denver metro is still relatively fast-moving.

Price reductions are also an indicator of the mismatch between supply and demand. 22.7% of active listings in July saw price reductions compared to the national average of 15.5%. For the Denver metro, this is a 7.7% decrease in price-reduced listings compared to the same month last year, which shows the disconnect between buyer and seller expectations narrowed. If this continues, we may soon see a more balanced market, and we can all stay comfortably “warm” as fall and winter approach.

Jacksonville, FL – Watson Realty Corp

Jacksonville is the largest city in the state of Florida and the largest city by area in the contiguous United States. The steady population growth makes the city perfect for real estate investors. Jacksonville is currently a seller’s market with strong pricing and low days on market. The median price is up 3.1%, over last year, to $360,000 and 23% of those sales are cash buyers.

Looking ahead, based on trends, we anticipate seeing a modest increase of 0.5% in housing market performance by year-end. The overall economy is completely diversified and continues to develop. Jacksonville is home to numerous Fortune 500 companies and different businesses that give employment to the present and future. The availability of jobs is set to increase by 42% in the next 10 years.

Jacksonville consistently features in the rundown for real urban communities with a low cost of living. Housing, especially in a few territories, is stunningly affordable compared with the numerous different urban areas on the East Coast. The cost of living isn’t just lower than the U.S. national average, but at the same time, it’s lower than the Florida average.

Source: www.statista.com

Newark, NJ – Turpin Realtors

The story of north central New Jersey’s residential real estate market continues to be one of the historically low inventory and continued strong buyer demand, resulting in increasing prices, especially in the popular under $2 million price range.

Our regional results indicate that overall, new listings are down 19% versus August 2022. This trend of tight supply is evidenced in our standing inventory as well, which was down 41% versus the same period last year.

By contrast, the number of pended sales in June was only 19% less than August 2022. The precipitous drop in inventory, combined with high demand resulted in a year-over-year increase of 10% in median listing price for pended homes across all prices.

In the $1-2 million price range, inventory declined while contracts pended increased slightly year over year, denoting a strong seller’s market for this segment as well. For homes priced above $2 million, inventory remained relatively flat, though contracts pended rose notably, especially in the $2-3 million range.

Though we are gratified to see how popular our beautiful corner of the world remains with buyers, we are also cognizant of the challenges that these unprecedented market conditions present to buyers. It appears that these trends are somewhat entrenched; until interest rates moderate, we can likely expect more of the same.

Oakland, Ca – Windermere Real Estate

In the second quarter of 2023, 9,999 homes were sold, which was a significant decrease from the more than 14,500 homes that sold in the second quarter of 2022. However, sales were up almost 50% compared to the first quarter of this year.

Listing inventory was up 15.2% from the first quarter, which likely contributed to better sales volume. Pending home sales were up 33.1% from the first quarter of 2023.

Higher mortgage rates continue to impact home prices. The average price of a home sold in the region dropped 7.1% from the second quarter of 2022, but sale prices were up 16.1% compared to the first quarter of this year. Overall, median list prices in the region rose 5.6% compared to the previous quarter.

The average time it took to sell a home in the Northern California counties in this report rose ten days compared to the second quarter of 2022. However, in the second quarter, it took an average of 36 days to sell a home, which was 15 fewer days than in the first quarter of the year.

It was interesting to see the housing market pick back up even though the economy appears to be on pause and mortgage rates are high. The question is whether this can continue. Despite higher supply levels, they remain well below historic averages, which is causing prices to rise. The reason for this is that 30% of homeowners in California have a mortgage rate at or below 3%, so there is no incentive to sell if they don’t have to.

Given all the above, the market is slightly more in favor of sellers but still fairly balanced.

As a member of Leading Real Estate Companies of the World, Fazendin Realtors is connected to hundreds of brokerages country-wide and worldwide. Whether you want more data about real estate markets across the United States or you’re moving to Minnesota, California, or Turkey, we can assist you.

Stay tuned next month for a Twin Cities market update.