Market Update: Looking Back at 2025

The 2025 Twin Cities residential real estate market did not develop the way most experts predicted; a dramatic increase in sales activity spurred by lower mortgage rates combined with pent up buyer demand. Rather, it was a year of slight adjustments and stabilization. This more measured pace, in market activity, was a relief after several years of rapid and unpredictable change. Buyers and sellers recalibrated expectations around pricing, timing, and financing. Tthe market remained fundamentally stable, even as overall home sales slowed compared to peak years of 2020-2022. Overall, the market found stability more akin to a “normal market”.

Mortgage Interest Rates

Entering 2025, many anticipated interest rate cuts. However, mortgage rates, which have an outsized influence on housing activity, remained higher than expected throughout the year, especially when compared to the historic lows of 2020 and 2021. The average 30-year fixed mortgage rate for the year was approximately 6.8%, a level that, while higher than recent years, aligns more closely with historical norms. For context, the 25-year average mortgage rate is approximately 5.9%.

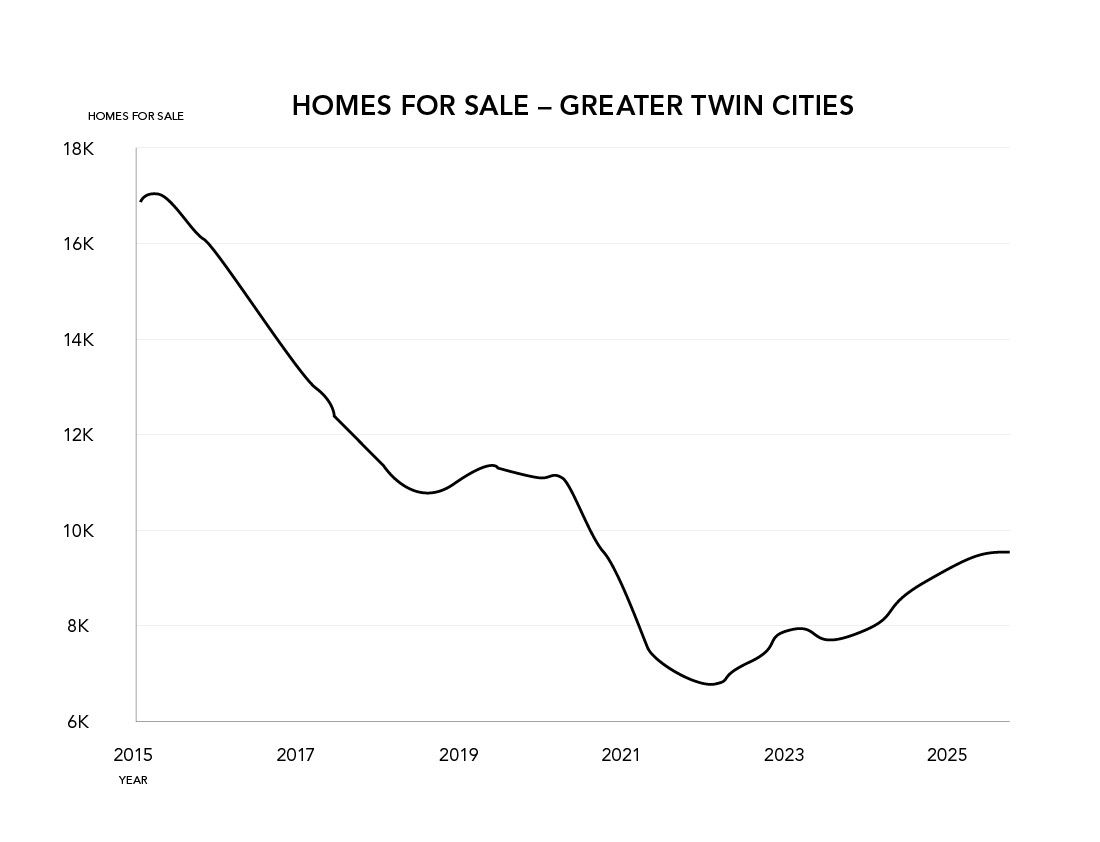

Sales & Inventory of Homes for Sale

In this environment, success favored those who planned ahead. Buyers who recognized the value of financial preparedness were able to act decisively, whereas sellers benefited most when prices reflected payment-sensitive demand rather than past peak values.

Housing inventory showed gradual improvement in 2025, particularly in the second half of the year. Even so, overall supply remained below long-term averages, especially in entry-level and move-up price ranges. Well-maintained, professionally marketed and properly priced homes continued to attract strong interest, while properties priced too aggressively, not fully aligned with current buyer expectations, and poorly represented often required more time and negotiation to secure a sale.

Home Prices

Home prices across the Twin Cities remained largely stable, with modest variation by price segment and property type. Overall, the median sales price increased approximately 2.6% in 2025. Entry-level and mid-range single-family homes generally held their value due to steady demand, while higher-priced properties, condos, and townhomes experienced longer marketing times and more price discussions.

Market Update: Looking Ahead to 2026

Looking ahead to provide a market update for 2026, most forecasts suggest modest easing in interest rates, regardless of actions taken by the Federal Reserve.

Even if the Fed were to implement significant rate cuts, mortgage rates may decline only modestly, or potentially not at all, depending on broader economic conditions. Mortgage rates do not move in lockstep with Federal Reserve decisions.

That said, even small reductions in rates could bring sidelined buyers back into the market.

Inventory is expected to continue improving as homeowners adapt to the current rate environment and make decisions driven by life changes. With demand remaining steady and supply still constrained, significant price declines appear unlikely. Current indicators point toward moderate and sustainable growth in the Twin Cities housing market. Real estate markets are inherently difficult to predict, and history reminds us that forecasts are often imperfect. Whatever unfolds in 2026, we remain committed to keeping you informed.

As we close the chapter on 2025 and look ahead to 2026, we want to express our sincere gratitude to our clients. Your trust, referrals, and ongoing conversations are the foundation of our business at Fazendin Realtors. If you have questions about the real estate market or your housing plans, please don’t hesitate to reach out, we are always ready to help. We look forward to continuing our relationship in 2026 and beyond, and to serving as a trusted resource whenever you need guidance. •