Last year was an interesting one for residential real estate. After years of robust sales in the Twin Cities residential real estate market, we experienced an abrupt deceleration toward the end of 2022. It is no coincidence that the decrease in sales coincided with the rapid increase in mortgage interest rates. As sales slowed, market conditions began moving from a hyper-charged seller’s market to more of a balanced market. We think the trend toward a more normal and balanced market will continue through 2023 and present opportunities for both buyers and sellers.

Last year’s real estate market was similar to 2021 but more intense. To say it was a “hot” market last spring would be an understatement. The frenzied market was caused by extremely low interest rates, which created demand, combined with historically low listing supply. As the year progressed, the Federal Reserve ratcheted up interest rates at a pace never experienced. Rates were around 3.5% at the beginning of 2022, but by August rates had reached 7.5% for a fixed 30-year mortgage. This had a chilling effect on buyers and real estate sales plummeted quickly in response. After the initial shock of the dramatic increase in rates, consumers have progressively become more comfortable with current interest rates. Rates climbed dramatically but are still below historical norms. Between April 1971 and December 2022, 30-year fixed-rate mortgages averaged 7.76%. Currently, the rate is around 6.5% for the same loan. Some potential buyers have decided to abandon their hopes of purchasing a home, but most have adjusted their expectations and are moving forward with their home-buying plans.

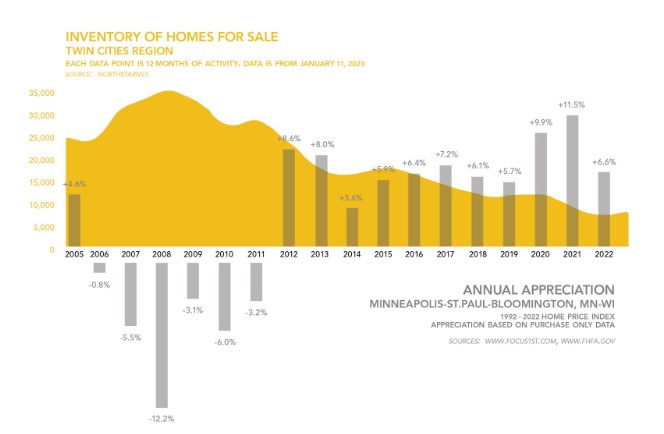

While increased interest rates reduce one’s buying power, there is an upside for buyers: less competition and more choices. A year ago, most listings were receiving multiple offers and selling immediately above asking price. Buyers were not only paying above listing price but they also often had to make significant concessions such as waiving inspections and overlooking deficiencies that would typically be remedied by sellers. This is no longer common; we have returned to a more normal market because there are fewer buyers with which to compete. This lack of competition has also allowed listing inventory to grow. Listing inventory reached its lowest level last March and has been increasing ever since, albeit slowly. This is welcome news for buyers.

The return to a normal market is not all bad for sellers. While sellers are less likely to have 10 offers on day one of a listing, listings are still selling rapidly and at (or near) list price when priced and marketed correctly. Furthermore, home values continue to increase. The median sale price increased 6.6% last year, a good return on investment in a declining market. Due to low inventory, we think it is unlikely that home values will decrease in 2023. The hot market during the past few years prohibited many potential sellers from listing their homes for sale because they were fearful they couldn’t find a home to which to move and decided to stay put. With increasing listings to choose from, we hope many of these potential sellers will decide to finally list their homes for sale. We anticipate that listing inventory will increase but still stay below what is considered a balanced market. This low supply dynamic should protect home values from decreasing.

Overall, and despite the headlines, we are optimistic about 2023 home sales in the Twin Cities region. We have strong employment based on a stable and diverse local economy. Furthermore, our market did not experience a lot of speculative buying or second home purchases, which makes housing markets more vulnerable. Overall, we anticipate modest price appreciation in 2023 in the Twin Cities market. There will be segments that will perform better than others; some may even see a decline. We will be keenly watching inflation numbers because of their influence on mortgage interest rates. At this point it is impossible to predict, but there are indications that inflation is finally under control. If that is the case, the Fed will ease off on interest rate increases.

I hope you found this information helpful. The past year has been turbulent for home buyers and sellers, but the market appears to be trending toward a more normal and balanced market. Whether you are buying, selling, or just curious about the market I encourage you to contact us, your trusted and informed real estate resources. Fazendin Realtors is in its 58th year in business, and looks forward to continuing its promise of delivering all those in the Twin Cities community the service they deserve, the knowledge they need, and the result they desire.