It has been an interesting first quarter for the Twin Cities residential real estate market. Some aspects, such as low listing inventory and increasing prices, have remained the same. There are other aspects that are new and somewhat unpredictable. We are cautiously optimistic about the residential real estate market in the coming months. Here is a first-quarter market update for the overall Twin Cities residential housing market.

Low inventory continues to be the greatest challenge for home buyers. A “balanced” real estate market is when there is a 4-6 months’ supply of listings. The last time our market had more than 4 months’ supply was March 2013! Currently, there is a 1.6-month’s supply of listings, which is an increase over 12 months ago when the supply was 1.2 months, but we remain in an unbalanced market when we consider the supply/demand dynamic.

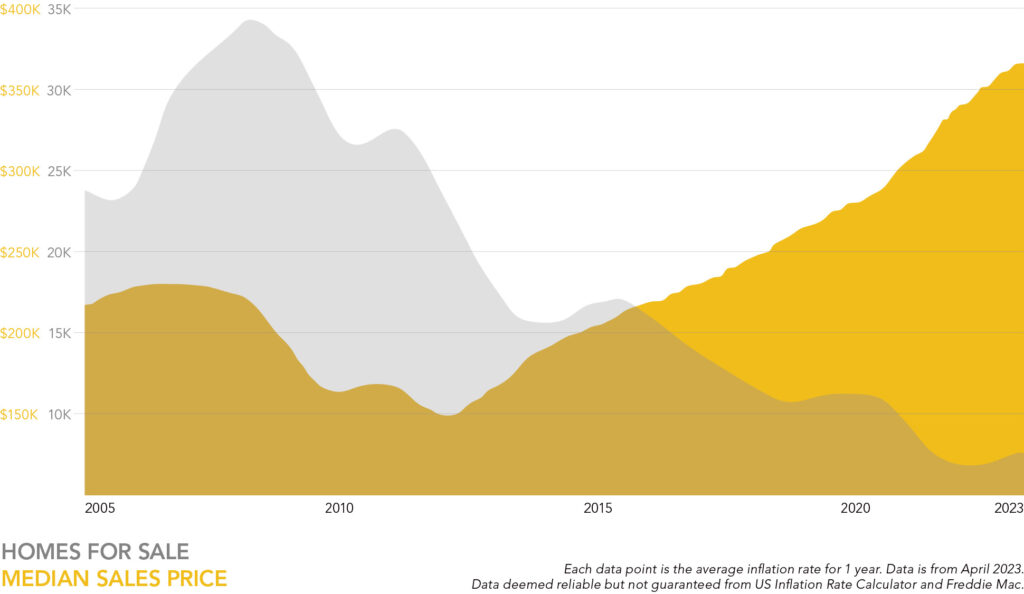

Home prices have continued to increase in the Twin Cities market but at a more modest rate than in the past few years. This contrasts with other markets around the US, which have garnered headlines of a real estate recession. Markets that experienced massive increases, such as San Francisco, Boise, and Seattle, are experiencing decreasing home values. These markets boomed for one or two reasons: they offered a different lifestyle which attracted those who transitioned to working remotely during the pandemic (Boise) or are disproportionately reliant upon certain business sectors (a good example is the San Francisco Bay area which is heavy on technology). The Twin Cities have had robust employment, a variety of industries and were not a major housing destination during the pandemic. Therefore, we are less vulnerable to market swings. Currently, the median home price in the Twin Cities region is $365,000, a 5.5% increase in the past year.

The real estate market was heavily influenced by mortgage interest rates in 2022. Last year low rates spurred an extremely active spring market; rates had increased but were still low. However, the rapid increase in interest rates began to take a toll by mid-summer. The entire Twin Cities real estate market experienced an abrupt slowdown and sales faltered in the third and fourth quarter. As fear of inflation subsides, we should see more stability in mortgage interest rates. It is impossible to predict, but most economists believe interest rates will be lower by year’s end than they are currently.

Like interest rates, the weather is a somewhat unpredictable influencer of Minnesota’s housing market. The late arrival of spring has played a role in the lack of new listings and effectively delayed this year’s spring market. In fact, we have seen 20% fewer properties listed for sale this year than last year. In a nutshell, many sellers are reluctant to list their home before the snow melts, lawns green up, and trees begin to bud. This last winter was a doozy for both snow amounts and duration. The good news is that spring has finally arrived, and buyers are hopeful an increase in listings will follow.

You have probably heard the adage about the three most important rules in real estate: location, location, location. Indeed, location matters, and it matters more now than ever. Listings in high-demand areas that are marketed and priced correctly are selling as they did last year: quickly, at or above list price and usually in multiple offers. Properties not priced and marketed correctly in lesser demand areas are sitting on the market longer. Buyers have become more discerning and are no longer overlooking aspects of a home as they were during last year’s frenzied spring market. However, there is intense competition for properties in the higher demand areas.

We are four months into 2023 and the condition of our local real estate market is becoming clearer than it was at the beginning of the year. If inflation remains under control, which will keep rates from spiking, we anticipate a healthy year of real estate sales. The market favors sellers due to the supply/demand imbalance. This imbalance should also keep prices stable in most areas of the Twin Cities. Compared to last spring, buyers should have less competition, which will decrease the pressure and stress of last year’s market.

Local market conditions will vary not only from city to city but block to block. Understanding local conditions is Fazendin agents’ bread and butter. If you are curious about market conditions in your neighborhood, I encourage you to contact us.

R. Andy Fazendin

Owner/Broker of Fazendin Realtors